prince william county real estate tax relief

Contact the County that you moved from and then call Prince William County at 703-792-6710. Elderly Citizens and Disabled Persons who meet certain criteria may be granted relief from all or part of their real estate taxes personal property tax on one vehicle the vehicle registrationlicense fee and the solid waste fee.

Prince William Wants To Hike Property Taxes Introduces Meals Tax

July 2 2022.

. This legislation was done by passing a ruling to increase the Grantor Tax in the form of a Congestion Relief Fee. Make a Quick Payment. End Your Tax Nightmare Now.

About the Company Prince William County Personal Property Tax Relief CuraDebt is an organization that deals with debt relief in Hollywood Florida. You will need to create an account or login. 9994 Sowder Village Square 816.

Does the Congestion Relief Fee. 45 of the tax due on the first 20000 of assessed value. Payment by e-check is a free service.

The business relief fund would use up to 1 million in existing. It was founded in 2000 and has been an active participant in the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators. 9994 Sowder Village Square 816 Manassas VA 20109 Phone.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. About the Company Property Tax Relief For Seniors In Prince William County Va CuraDebt is a debt relief company from Hollywood Florida. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check.

Celebrating July 4th Traditions in Prince William County. Contact each County within 60 days of moving to avoid continued assessment in the County you are no longer living in and to be assessed accordingly by Prince William County. Report changes for individual accounts.

By creating an account you will have access to balance and account information notifications etc. It was founded in 2000 and is a member of the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators. Report a Change of Address.

Prince William County Code Chapter 26 Article V Eligibility criteria may change from year to year. You can pay a bill without logging in using this screen. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. If you have questions about this site please email the Real Estate Assessments Office. 2 days agoPrince William County Real Estate Taxes Due July 15 2022.

So for example on a 400000 home sale the tax would be 1000. Percentage of Tax Relief. Ad 5 Best Tax Relief Companies of 2022.

The fee is calculated at 025 per 100 of the sale price or fair market value whichever is higher. Still while the rate is dropping rising property values will result in. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of.

It was founded in 2000 and has been an active member of the American Fair Credit Council the US Chamber of Commerce and accredited by the International Association of Professional Debt Arbitrators. It was established in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and has been accredited with the International Association of Professional Debt Arbitrators. Revitalization Route 1 Refresh Grant Program Launches July 1.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. The Taxpayer Services in-person and telephone office hours are Monday Tuesday Thursday and Friday from 800. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

The Tax Relief for the Elderly and Disabled is authorized under the Code of Virginia 581-3210. About the Company Prince William County Property Tax Relief For Seniors CuraDebt is an organization that deals with debt relief in Hollywood Florida. A convenience fee is added to payments by credit or debit card.

Advertise in Prince William Living. Prince William County Virginia Home. Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday.

Click here to register for an account or here to login if you already have an account. Provided by Prince William County Communications Office. Prince Williams board of supervisors is moving toward adopting a budget for fiscal year 2021 that keeps the countys real estate property tax.

The board voted unanimously to defer payments for the first half of annual real estate taxes originally due today July 15 -- until Oct. The board also added a small business relief fund and a housing emergency aid program that would not require new county spending. If you have questions about the real estate assessment process please contact the Real Estate Assessments Office at 703-792-6780 or email protected.

All you need is your tax account number and your checkbook or credit card. If you have not received a tax bill for your property and believe you should have contact the Taxpayer Services Office at 703-792-6710 or by email at email protected. About the Company Prince William County Va Real Estate Tax Relief CuraDebt is an organization that deals with debt relief in Hollywood Florida.

It was established in 2000 and has since become a part of the American Fair Credit Council the US Chamber of Commerce and has been accredited by the International Association of Professional Debt Arbitrators. About the Company Prince William County Virginia Property Tax Relief CuraDebt is a company that provides debt relief from Hollywood Florida. How is the Congestion Relief Fee Calculated.

The county is proposing a decrease in its tax rate from 1115 per 100 of assessed value to 105. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. The Finance Department of Prince William County administers a real estate tax relief program for older adults age 65 and older as well as adults with total and permanent disability who meet the income and asset guidelines.

Other public information available at the real estate assessments office includes sale prices and dates legal descriptions descriptions of the land and buildings and ownership information. To qualify an applicant must. Revitalization Route 1 Refresh Grant Program Launches July 1.

At Tuesdays Board of Supervisors meeting county officials proposed a further reduction in the real estate tax rate from 1115 per 100 of assessed value to 103 in the budget for fiscal 2023. 1 day agoPrince William County Real Estate Taxes Due July 15 2022.

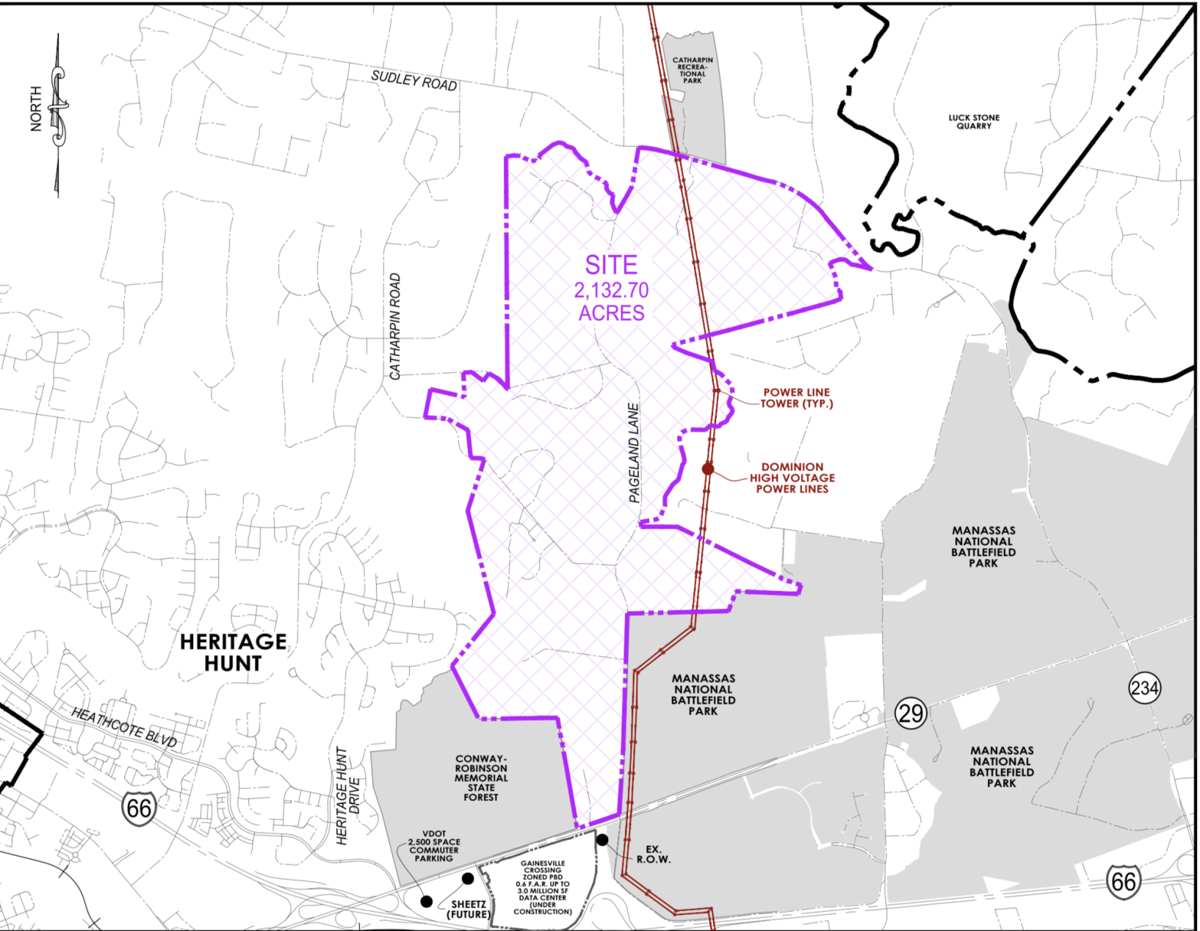

More Data Centers For Prince William County S Innovation Park Wtop News

Data Center Opportunity Zone Presented By Prince William County Va Department Of Economic Development Date May 20 Ppt Download

Rural Crescent In Prince William County

The Rural Area In Prince William County

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Class Specifications Sorted By Classtitle Ascending Prince William County

Rural Crescent In Prince William County

Prince William County Park Rangers New On Call Number Effective April 1 2022

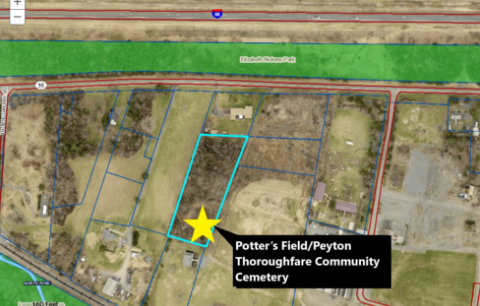

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community

Prince William Officials Discuss Data Center Impact On Water Quality Headlines Insidenova Com

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Acting County Executive Proposes The Fiscal Year 2023 Budget Prince William Living

Prince William County Partners With Human Services Alliance To Award More Than 6 Million For Covid 19 Recovery

Prince William County Data Center Site Sells For 74 5 Million Dcd